Atomization – Auto Industry Apocalypse Ahead – Vehicle Nameplates Soar as Sales Fall

- September 9, 2018

- Auto News & Reviews, Automobile Cool News

- Posted by George Peterson

- Comments Off on Atomization – Auto Industry Apocalypse Ahead – Vehicle Nameplates Soar as Sales Fall

Over the past decades, the American auto industry has “atomized” with more and more new car and light truck models being added to the lineups each year. The reason for this rapid addition of nameplates – atomization – has been an attempt by auto designers and marketers to provide products targeted to much more finely defined product niches. Consumers demand more and more focused products and today’s automotive consumer research can identify exactly what those consumers want. Current product development techniques allow vehicles to be developed more quickly and efficiently than in the past. So, why not develop a vehicle targeted at each well-defined buyer group?

17-million Sales Years Not Sustainable

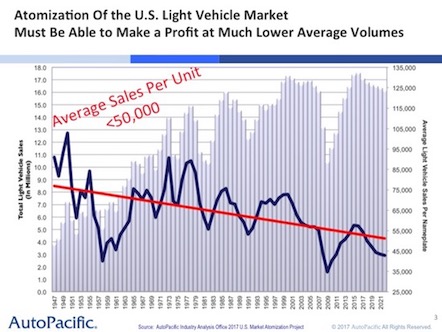

During the ‘90s, a good year was 15 million car and light truck sales. By early in the first decade of the 2000s, the industry was expecting 17 million units per year. Companies began adding more and more nameplates to take advantage of these robust sales numbers and to target their customers more closely. As more nameplates were added, the market softened.

At the industry peak in 2000, sales hit 17.3 million units and there were 232 car and light truck nameplates on the market in the United States. This resulted in an average sales volume of about 73,000 units per nameplate. In 2010 the industry cratered to 10.2 million units. There were 301 nameplates resulting in an average of only 34,000 units sold per nameplate; a whopping 39,000-unit deterioration in the average sales volume per nameplate from 2000.

Jump forward to 2017, the next peak sales year when sales hit 17.2 million units. The nameplate count remained stable at 302 nameplates. Average sales per nameplate in 2017 were about 57,000 units. However, due to adding nameplates, the average was still 16,000 lower than in the year 2000 on average. In a 17 million unit year, a lot of nameplates can be fed.

Forecast for 2023 – 15.7-million Sales but 80 more Nameplates to Sell – Atomization

But, as history has shown, 17 million unit sales years are not sustainable. AutoPacific’s Industry Analysis team forecasts sales for 2023 will be 15.7 million units. Automakers have plans to add 80 more nameplates between 2017 and 2023. This means that 382 nameplates will average just 41,000 sales apiece.

In 2017, there were 163 car nameplates and 139 truck (pickups, SUVs, crossovers and vans) nameplates. In 2019 there will be more truck nameplates than cars and by 2023 there are forecast to be 214 truck nameplates. Most of these added trucks are SUVs and crossovers. Truck penetration in the market is expected to be 72% in 2023. Crossover SUVs alone will add about 70 nameplates between 2017 and 2023!

Top Ten Vehicles Account for 27% of Sales

To add to the challenge, the top ten best-selling vehicles, like the Ford F-Series, Chevrolet Silverado, Ram 1500, etc., account for 27% of the market. In 2023, that leaves 372 nameplates to battle over about 11,500,000 sales after removing the top ten volume. The result is a further drop in average sales per nameplate to about 31,000.

This is a very simplistic analysis, but it is clear that the next five years will be a marketing challenge for the automotive industry. “The marketing challenge is real,” says AutoPacific president George Peterson. “AutoPacific has helped many automakers launch targeted new vehicles and how they navigate this impending crisis should result in a marketing war that hasn’t been seen in years.”

• • • • •

AutoPacific is an automotive specialist research and product planning consulting firm headquartered in North Tustin, California. Since 1986, AutoPacific has been providing market and product research services to automotive OEMs and Tier 1 suppliers around the world. This press release is based on an analysis by AutoPacific’s Industry Analysis team “Atomization – the 2018 View Looking to 2023 – Auto Crisis on the Horizon.”

Contact George Peterson at 714.838.4234 or Ed Kim at 562.541.5360 to discuss these results.